Wawa Breach May Have Compromised More Than 30 Million Payment Cards

In late December 2019, fuel and convenience store chain Wawa Inc. said a nine-month-long breach of its payment card processing systems may have led to the theft of card data from customers who visited any of its 850 locations nationwide. Now, fraud experts say the first batch of card data stolen from Wawa customers is being sold at one of the underground’s most popular crime shops, which claims to have 30 million records to peddle from a new nationwide breach.

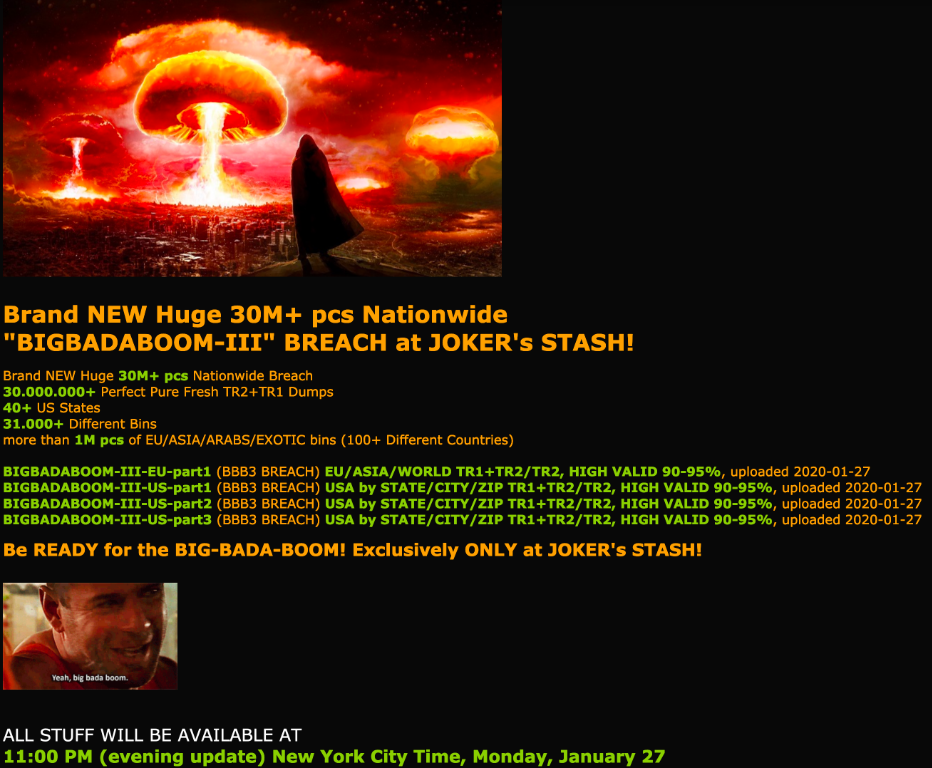

On the evening of Monday, Jan. 27, a popular fraud bazaar known as Joker’s Stash began selling card data from “a new huge nationwide breach” that purportedly includes more than 30 million card accounts issued by thousands of financial institutions across 40+ U.S. states.

The fraud bazaar Joker’s Stash on Monday began selling some 30 million stolen payment card accounts that experts say have been tied back to a breach at Wawa in 2019.

Two sources that work closely with financial institutions nationwide tell KrebsOnSecurity the new batch of cards that went on sale Monday evening — dubbed “BIGBADABOOM-III” by Joker’s Stash — map squarely back to cardholder purchases at Wawa.

On Dec. 19, 2019, Wawa sent a notice to customers saying the company had discovered card-stealing malware installed on in-store payment processing systems and fuel dispensers at potentially all Wawa locations.

Pennsylvania-based Wawa says it discovered the intrusion on Dec. 10 and contained the breach by Dec. 12, but that the malware was thought to have been installed more than nine months earlier, around March 4. The exposed information includes debit and credit card numbers, expiration dates, and cardholder names. Wawa said the breach did not expose personal identification numbers (PINs) or CVV records (the three-digit security code printed on the back of a payment card).

A spokesperson for Wawa confirmed that the company today became aware of reports of criminal attempts to sell some customer payment card information potentially involved in the data security incident announced by Wawa on December 19, 2019.

“We have alerted our payment card processor, payment card brands, and card issuers to heighten fraud monitoring activities to help further protect any customer information,” Wawa said in a statement released to KrebsOnSecurity. “We continue to work closely with federal law enforcement in connection with their ongoing investigation to determine the scope of the disclosure of Wawa-specific customer payment card data.”

“We continue to encourage our customers to remain vigilant in reviewing charges on their payment card statements and to promptly report any unauthorized use to the bank or financial institution that issued their payment card by calling the number on the back of the card,” the statement continues. “Under federal law and card company rules, customers who notify their payment card issuer in a timely manner of fraudulent charges will not be responsible for those charges. In the unlikely event any individual customer who has promptly notified their card issuer of fraudulent charges related to this incident is not reimbursed, Wawa will work with them to reimburse them for those charges.”

Gemini Advisory, a New York-based fraud intelligence company, said the biggest concentrations of stolen cards for sale in the BIGBADABOOM-III batch map back to Wawa customer card use in Florida and Pennsylvania, the two most populous states where Wawa operates. Wawa also has locations in Delaware, Maryland, Virginia and the District of Columbia.

According to Gemini, Joker’s Stash has so far released only a small portion of the claimed 30 million. However, this is not an uncommon practice: Releasing too many stolen cards for sale at once tends to have the effect of depressing the overall price of stolen cards across the underground market.

“Based on Gemini’s analysis, the initial set of bases linked to “BIGBADABOOM-III” consisted of nearly 100,000 records,” Gemini observed. “While the majority of those records were from US banks and were linked to US-based cardholders, some records also linked to cardholders from Latin America, Europe, and several Asian countries. Non-US-based cardholders likely fell victim to this breach when traveling to the United States and utilizing Wawa gas stations during the period of exposure.”

Gemini’s director of research Stas Alforov stressed that some of the 30 million cards advertised for sale as part of this BIGBADABOOM batch may in fact be sourced from breaches at other retailers, something Joker’s Stash has been known to do in previous large batches.

Gemini monitors multiple carding sites like Joker’s Stash. The company found the median price of U.S.-issued records in the new Joker’s Stash batch is currently $17, with some of the international records priced as high as $210 per card.

“Apart from banks with a nationwide presence, only financial institutions along the East Coast had significant exposure,” Gemini concluded.

Representatives from MasterCard did not respond to requests for comment. Visa declined to comment for this story, but pointed to a series of alerts it issued in November and December 2019 about cybercrime groups increasingly targeting fuel dispenser merchants.

A number of recent high-profile nationwide card breaches at main street merchants have been linked to large numbers of cards for sale at Joker’s Stash, including breaches at supermarket chain Hy-Vee, restaurant chains Sonic, Buca di Beppo, Krystal, Moe’s, McAlister’s Deli, and Schlotzsky’s, retailers like Bebe Stores, and hospitality brands such as Hilton Hotels.

Most card breaches at restaurants and other brick-and-mortar stores occur when cybercriminals manage to remotely install malicious software on the retailer’s card-processing systems. This type of point-of-sale malware is capable of copying data stored on a credit or debit card’s magnetic stripe when those cards are swiped at compromised payment terminals, and that data can then be used to create counterfeit copies of the cards.

The United States is the last of the G20 nations to make the shift to more secure chip-based cards, which are far more expensive and difficult for criminals to counterfeit. Unfortunately, many merchants have not yet shifted to using chip-based card readers and still swipe their customers’ cards.

According to stats released in November by Visa, more than 3.7 million merchant locations are now accepting chip cards. Visa says for merchants who have completed the chip upgrade, counterfeit fraud dollars dropped 81 percent in June 2019 compared to September 2015. This may help explain why card thieves increasingly are shifting their attention to compromising e-commerce merchants, a trend seen in virtually every country that has already made the switch to chip-based cards.

Many filling stations are upgrading their pumps to include more cyber and physical security — such as end-to-end encryption of card data, custom locks and security cameras. In addition, newer pumps can accommodate more secure chip-based payment cards that are already in use and in some cases mandated by other G20 nations.

But these upgrades are disruptive and expensive, and many fuel station owners are putting them off until it is absolutely necessary. Prior to late 2016, fuel station owners in the United States had until October 1, 2017 to install chip-capable readers at their pumps. Station owners that didn’t have chip-ready readers in place by then would have been on the hook to absorb 100 percent of the costs of fraud associated with transactions in which the customer presented a chip-based card yet was not asked or able to dip the chip (currently, card-issuing banks and consumers eat most of the fraud costs from fuel skimming).

Yet in December 2016, Visa — by far the largest credit card network in the United States — delayed the requirements, saying fuel station owners would be given until October 1, 2020 to meet the liability shift deadline.

Either way, Wawa could be facing steep fines for failing to protect customer card data traversing its internal payment card networks. In addition, at least one class action lawsuit has already been filed against the company.

Finally, it’s important to note that even if all 30 million of the cards that Joker’s Stash is selling as part of this batch do in fact map back to Wawa locations, it’s highly unlikely that more than a small percentage of these cards will actually be purchased and used by fraudsters. In the 2013 megabreach at Target Corp., for example, fraudsters stole roughly 40 million cards but only ended up selling between one to three million of those cards.

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.