MyPayrollHR CEO Arrested, Admits to $70M Fraud

Earlier this month, employees at more than 1,000 companies saw one or two paycheck’s worth of funds deducted from their bank accounts after the CEO of their cloud payroll provider absconded with $35 million in payroll and tax deposits from customers. On Monday, the CEO was arrested and allegedly confessed that the diversion was the last desperate gasp of a financial shell game that earned him $70 million over several years.

Michael T. Mann, the 49-year-old CEO of Clifton Park, NY-based MyPayrollHR, was arrested this week and charged with bank fraud. In court filings, FBI investigators said Mann admitted under questioning that in early September — on the eve of a big payroll day — he diverted to his own bank account some $35 million in funds sent by his clients to cover their employee payroll deposits and tax withholdings.

After that stunt, two different banks that work with Mann’s various companies froze those corporate accounts to keep the funds from being moved or withdrawn. That action set off a chain of events that led another financial institution that helps MyPayrollHR process payments to briefly pull almost $26 million out of checking accounts belonging to employees at more than 1,000 companies that use MyPayrollHR.

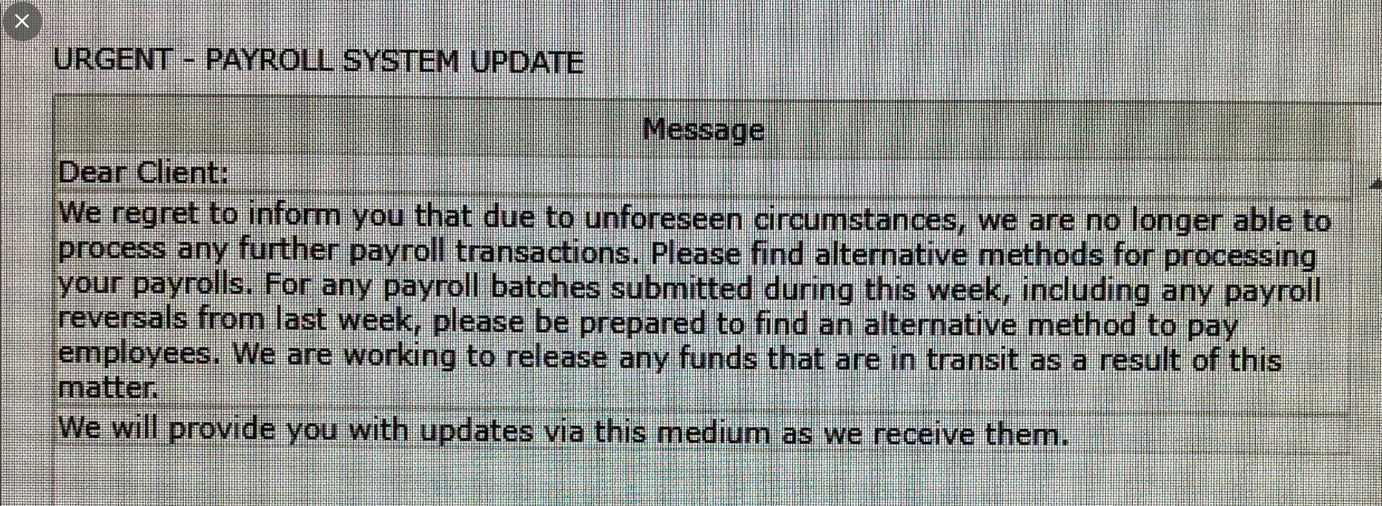

At the same time, MyPayrollHR sent a message (see screenshot above) to clients saying it was shutting down and that customers should find alternative methods for paying employees and for processing payroll going forward.

In the criminal complaint against Mann (PDF), a New York FBI agent said the CEO admitted that starting in 2010 or 2011 he began borrowing large sums of money from banks and financing companies under false pretenses.

“While stating that MyPayroll was legitimate, he admitted to creating other companies that had no purpose other than to be used in the fraud; fraudulently representing to banks and financing companies that his fake businesses had certain receivables that they did not have; and obtaining loans and lines of credit by borrowing against these non-existent receivables.”

“Mann estimated that he fraudulently obtained about $70 million that he has not paid back. He claimed that he committed the fraud in response to business and financial pressures, and that he used almost all of the fraudulently obtained funds to sustain certain businesses, and purchase and start new ones. He also admitted to kiting checks between Bank of America and Pioneer [Savings Bank], as part of the fraudulent scheme.”

Check-kiting is the illegal act of writing a check from a bank account without sufficient funds and depositing it into another bank account, explains MagnifyMoney.com. “Then, you withdraw the money from that second account before the original check has been cleared.”

Kiting also is known as taking advantage of the “float,” which is the amount of time between when an individual submits a check as payment and when the individual’s bank is instructed to move the funds from the account.

Magnify Money explains more:

“Say, for example, that you write yourself a check for $500 from checking account A, and deposit that check into checking account B — but the balance in checking account A is only $75. Then, you promptly withdraw the $500 from checking account B. This is check-kiting, a form of check fraud that uses non-existent funds in a checking account or other type of bank account. Some check-kiting schemes use multiple accounts at a single bank, and more complicated schemes involve multiple financial institutions.”

“In a more complex scenario, a person could open checking accounts at bank A and bank B, at first depositing $500 into bank A and nothing in bank B. Then, they could write a check for $10,000 with account A and deposit it into account B. Bank B immediately credits the account, and in the time it might take for bank B to clear the check (generally about three business days), the scammer writes a $10,000 check with bank B, which gets deposited into bank A to cover the first check. This could keep going, with someone writing checks between banks where there’s no actual funds, yet the bank believes the money is real and continues to credit the accounts.”

The government alleges Mann was kiting millions of dollars in checks between his accounts at Bank of American and Pioneer from Aug. 1, 2019 to Aug. 30, 2019.

For more than a decade, MyPayrollHR worked with California-based Cachet Financial Services to process payroll deposits for MyPayrollHR client employees. Every other week, MyPayrollHR’s customers would deposit their payroll funds into a holding account run by Cachet, which would then disburse the payments into MyPayrollHR client employee bank accounts.

But when Mann diverted $26 million in client payroll deposits from Cachet to his account at Pioneer Bank, Cachet’s emptied holding account was debited for the payroll payments. Cachet quickly reversed those deposits, causing one or two pay periods worth of salary to be deducted from bank accounts for employees of companies that used MyPayrollHR.

That action caused so much uproar from affected companies and their employees that Cachet ultimately decided to cancel all of those reversals and absorb that $26 million hit, which it is now trying to recover through the courts.

According to prosecutors in New York, Pioneer was Mann’s largest creditor.

“Mann stated that the payroll issue was precipitated by his decision to route MyPayroll’s clients’ payroll payments to an account at Pioneer instead of directly to Cachet,” wrote FBI Special Agent Matthew J. Wabby. “He did this in order to temporarily reduce the amount of money he owed to Pioneer. When Pioneer froze Mann’s accounts, it’s also (inadvertently) stopped movement of MyPayroll’s clients’ payroll payments to Cachet.”

Approximately $9 million of the $35 million diverted by Mann was supposed to go to accounts at the National Payment Corporation (NatPay) — the Florida-based firm which handles tax withholdings for MyPayrollHR clients. NatPay said its insurance should help cover the losses it incurred when MyPayrollHR’s banks froze the company’s accounts.

Court records indicate Mann hasn’t yet entered a plea, but that he was ordered to be released today under a $200,000 bond secured by a family home and two vehicles. His passport also was seized.

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.