Business money talks for wary venture funds focused on tech start-ups

Iraq’s Kurds declare independence in cyberspace with .krd domain name

April 14, 2016‘Blackhole’ Exploit Kit Author Gets 8 Years

April 14, 2016

Tech start-ups aimed at businesses rather than consumers are winning more funding from increasingly wary venture capital investors who want to see a return on their cash sooner rather than later.

This shift has enabled Soundtrack Your Brand, which plans a U.S. launch this year, to secure $11 million to back its tailor-made music playlists for companies with deep pockets like Starbucks and McDonald’s.

Investors are buying into the Spotify-backed Swedish company’s theory that piping the right music into such food outlets or retail stores will encourage coffee drinkers or shoppers to linger longer and spend more.

Soundtrack Your Brand says businesses pay about five times what consumers pay for their tunes, which strikes a chord with investors seeking more stable earnings.

“There is a trend away from consumer unicorns and valuations,” Andreas Liffgarden, the company’s chairman and co-founder, told Reuters.

“I can feel it when we’re out fundraising. Investors want real steady cash flow and proven business models,” he added.

This shift reflects a combination of market volatility, high valuations and growing fears of another tech bubble which have led venture capitalists to reassess risk and back more business-to-business (B2B) start-ups over those aimed at consumers.

Venture capital funds are also seeking a clearer way to cash in their investments. Tech.eu, which analyses tech data, said B2B made up 60 percent of all European exits last year.

“Investors are shunning non money-making companies. Monetisation has become a really big deal,” said Tim He, a partner at venture capital firm Northzone.

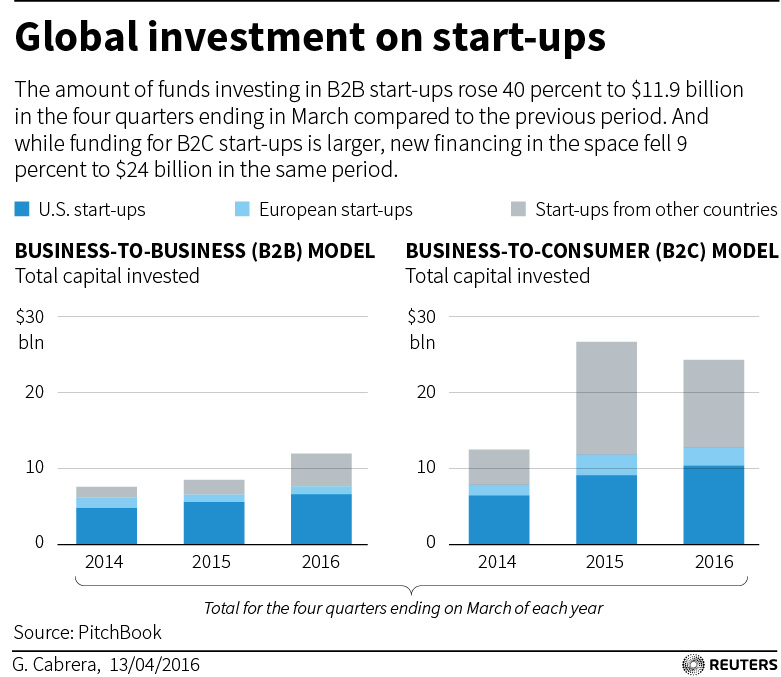

Funds invested in B2B start-ups rose by 40 percent to $11.9 billion year-on-year to the end of March, figures from venture capital database PitchBook show.

And although funding for business-to-consumer (B2C) start-ups remains larger, investment in this area fell 9 percent to $24 billion over the same period.

Philipp Leutiger, a partner at management consulting firm Roland Berger, describes B2B as “very hot” with investors hunting for capex-light business models with the potential to be profitable at a very early stage.

One of Europe’s most highly valued tech start-ups, Swedish payments firm Klarna, which support merchants and competes with the likes of Paypal has shown this is possible. It turned a profit in only its second year.

BACK TO BASICS

Dave McClure, founder of a venture capital seed fund and startup accelerator called 500 Startups in Silicon Valley, said that while 60 percent of his investments are in consumer-oriented companies, probably a bigger proportion of B2B start-ups are having greater success.

“For a lot of consumer start-ups, it’s not always obvious how you are going to monetize and there is a lot of competition for eyeballs,” he said. “For a lot of B2Bs, as long as you are able to get the initial customer in place there is a lot of potential for making money and continuing that business.”

Messaging software firm Slack, which is just three years old, already has almost one million paid users and customers including Samsung Electronics Co Ltd and the U.S. State Department. This month, Slack raised $200 million, giving it a $3.8 billion valuation.

Jonathan Userovici, an analyst at Idinvest Partners in Paris, is betting other B2Bs will grab venture capital money more easily than B2Cs this year as investors seek out recurring revenue-generators.

Human resources is attracting particular interest and Zenefits, whose software automates things like stock options and vacations, raised more than $500 million in the biggest U.S. B2B funding round last year, according to PitchBook data. It ran into regulatory troubles this year, a reminder that there are still risks involved in B2B investments.

And while B2B investments are considered more predictable than the hits-driven consumer business, the allure of consumer start-ups remains. In the past decade, the biggest consumer successes have produced far bigger returns than B2B firms.

That means not everyone is abandoning the consumer.

Sweden’s Kinnevik, a major investor in Europe’s biggest dedicated online fashion firm Zalando, is keen to keep its money in B2C investments. It just invested $65 million in Betterment which offers users automated investment advice.

McClure at 500 Startups is keeping a foot in both camps: “I don’t think we feel any less optimistic around consumers. I think we feel more optimistic about potential for B2B now that it’s starting to globalise and grow and have a greater reach.”

(Additional reporting by Sven Nordenstam; Editing by Alistair Scrutton and Alexander Smith)