Class Action Targets Experian Over Account Security

Scammers Sent Uber to Take Elderly Lady to the Bank

August 4, 2022Microsoft Patch Tuesday, August 2022 Edition

August 9, 2022A class action lawsuit has been filed against big-three consumer credit bureau Experian over reports that the company did little to prevent identity thieves from hijacking consumer accounts. The legal filing cites liberally from an investigation KrebsOnSecurity published in July, which found that identity thieves were able to assume control over existing Experian accounts simply by signing up for new accounts using the victim’s personal information and a different email address.

The lawsuit, filed July 28, 2022 in California Central District Court, argues that Experian’s documented practice of allowing the re-registration of existing Experian accounts without first verifying that the existing account holder authorized the changes violates the

In July’s Experian, You Have Some Explaining to Do, we heard from two different readers who had security freezes on their credit files with Experian and who also recently received notifications from Experian that the email address on their account had been changed. So had their passwords and account PIN and secret questions. Both had used password managers to pick and store complex, unique passwords for their accounts.

Both were able to recover access to their Experian account simply by recreating it — sharing their name, address, phone number, social security number, date of birth, and successfully gleaning or guessing the answers to four multiple choice questions that are almost entirely based on public records (or else information that is not terribly difficult to find).

Here’s the bit from that story that got excerpted in the class action lawsuit:

KrebsOnSecurity sought to replicate Turner and Rishi’s experience — to see if Experian would allow me to re-create my account using my personal information but a different email address. The experiment was done from a different computer and Internet address than the one that created the original account years ago.

After providing my Social Security Number (SSN), date of birth, and answering several multiple choice questions whose answers are derived almost entirely from public records, Experian promptly changed the email address associated with my credit file. It did so without first confirming that new email address could respond to messages, or that the previous email address approved the change.

Experian’s system then sent an automated message to the original email address on file, saying the account’s email address had been changed. The only recourse Experian offered in the alert was to sign in, or send an email to an Experian inbox that replies with the message, “this email address is no longer monitored.”

After that, Experian prompted me to select new secret questions and answers, as well as a new account PIN — effectively erasing the account’s previously chosen PIN and recovery questions. Once I’d changed the PIN and security questions, Experian’s site helpfully reminded me that I have a security freeze on file, and would I like to remove or temporarily lift the security freeze?

To be clear, Experian does have a business unit that sells one-time password services to businesses. While Experian’s system did ask for a mobile number when I signed up a second time, at no time did that number receive a notification from Experian. Also, I could see no option in my account to enable multi-factor authentication for all logins.

In response to my story, Experian suggested the reports from readers were isolated incidents, and that the company does all kinds of things it can’t talk about publicly to prevent bad people from abusing its systems.

“We believe these are isolated incidents of fraud using stolen consumer information,” Experian’s statement reads. “Specific to your question, once an Experian account is created, if someone attempts to create a second Experian account, our systems will notify the original email on file.”

“We go beyond reliance on personally identifiable information (PII) or a consumer’s ability to answer knowledge-based authentication questions to access our systems,” the statement continues. “We do not disclose additional processes for obvious security reasons; however, our data and analytical capabilities verify identity elements across multiple data sources and are not visible to the consumer. This is designed to create a more positive experience for our consumers and to provide additional layers of protection. We take consumer privacy and security seriously, and we continually review our security processes to guard against constant and evolving threats posed by fraudsters.”

That sounds great, but since that story ran I’ve heard from several more readers who were doing everything right and still had their Experian accounts hijacked, with little left to show for it except an email alert from Experian saying they had changed the address on file for the account.

I’d like to believe this class action lawsuit will change things, but I do not. Likely, the only thing that will come from this lawsuit — if it is not dismissed outright — is a fat payout for the plaintiffs’ attorneys and “free” credit monitoring for a few years compliments of Experian.

Credit bureaus do not view consumers as customers, who are instead the product that is being sold to third party companies. Often that data is sold based on the interests of the entity purchasing the data, wherein consumer records can be packaged into categories like “dog owner,” “expectant parent,” or “diabetes patient.”

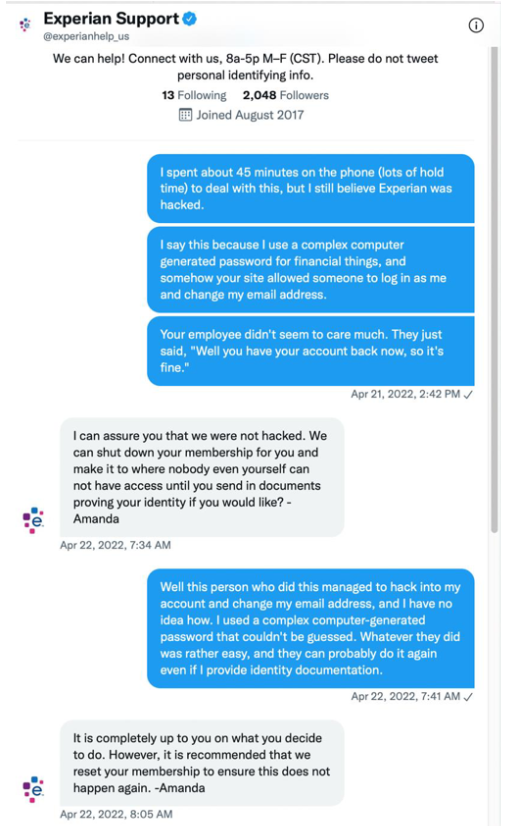

A chat conversation between the plaintiff and Experian’s support staff shows he experienced the same account hijack as described by our readers, despite his use of a computer-generated, unique password for his Experian account.

Nevertheless, most lenders rely on the big-three consumer credit reporting bureaus, including Equifax, Experian and Trans Union — to determine everyone’s credit score, fluctuations in which can make or break one’s application for a loan or job.

On Tuesday, The Wall Street Journal broke a story saying Equifax sent lenders incorrect credit scores for millions of consumers this spring.

Meanwhile, the credit bureaus keep enjoying record earnings. For its part, Equifax reported a record fourth quarter 2021 revenue of 1.3 billion. Much of that revenue came from its Workforce Solutions business, which sells information about consumer salary histories to a variety of customers.

The Biden administration reportedly wants to create a public entity within the Consumer Financial Protection Bureau (CFPB) that would incorporate factors like rent and utility payments into lending decisions. Such a move would require congressional approval but CFPB officials are already discussing how it might be set up, Reuters reported.

“Credit reporting firms oppose the move, saying they are already working to provide fair and affordable credit to all consumers,” Reuters wrote. “A public credit bureau would be bad for consumers because it would expand the government’s power in an inappropriate way and its goals would shift with political winds, the Consumer Data Industry Association (CDIA), which represents private rating firms, said in a statement.”

A public credit bureau is likely to meet fierce resistance from the Congress’s most generous constituents — the banking industry — which detests rapid change and is heavily reliant on the credit bureaus.

And there is a preview of that fight going on right now over the bipartisan American Data Privacy and Protection Act, which The Hill described as one of the most lobbied bills in Congress. The idea behind the bill is that companies can’t collect any more information from you than they need to provide you with the service you’re seeking.

“The bipartisan bill, which represents a breakthrough for lawmakers after years of negotiations, would restrict the kind of data companies can collect from online users and the ways they can use that data,” The Hill reported Aug. 3. “Its provisions would impact companies in every consumer-centric industry — including retailers, e-commerce giants, telecoms, credit card companies and tech firms — that compile massive amounts of user data and rely on targeted ads to attract customers.”

According to the Electronic Frontier Foundation, a nonprofit digital rights group, the bill as drafted falls short in protecting consumers in several areas. For starters, it would override or preempt many kinds of state privacy laws. The EFF argues the bill also would block the Federal Communications Commission (FCC) from enforcing federal privacy laws that now apply to cable and satellite TV, and that consumers should still be allowed to sue companies that violate their privacy.

A copy of the class action complaint against Experian is available here (PDF).